Last month’s ugly labor data shook markets. Will this week repeat? Good morning friend, Happy Labor...

Mortgage Market 9.29.25: Fed Cuts, Rising Rates, and Uncertainty

Government Shutdown Threatens Key Market Data

Last year’s October jobs surprise sent rates soaring; will history repeat?

Good morning friend,

This week’s market update comes with a little housekeeping: after years of sending these newsletters through Hubspot, I’m now drafting and sending them through my CRM system. Consider this a trial run, I’d love your feedback on the comparative quality as well if you have any to share!

As we close out Q3 and head into the holiday season, it’s more important than ever to reconnect with clients. With all the noise in the news, your sphere needs you to be the source of clarity. Be The News.

Since the Fed cut rates 25bps, mortgage pricing has been trending higher. Some recent economic data came in stronger than expected, and the big report to watch is Friday’s nonfarm payroll release. Last year, a strong October jobs report sent rates soaring right after a recent dip. Let’s hope for better this time, but stay prepared in case history repeats.

One more wrinkle to watch: if the government shuts down, the BLS said this morning that the jobs report will not be released Friday. Stay tuned.

Mortgage Rates ↗️

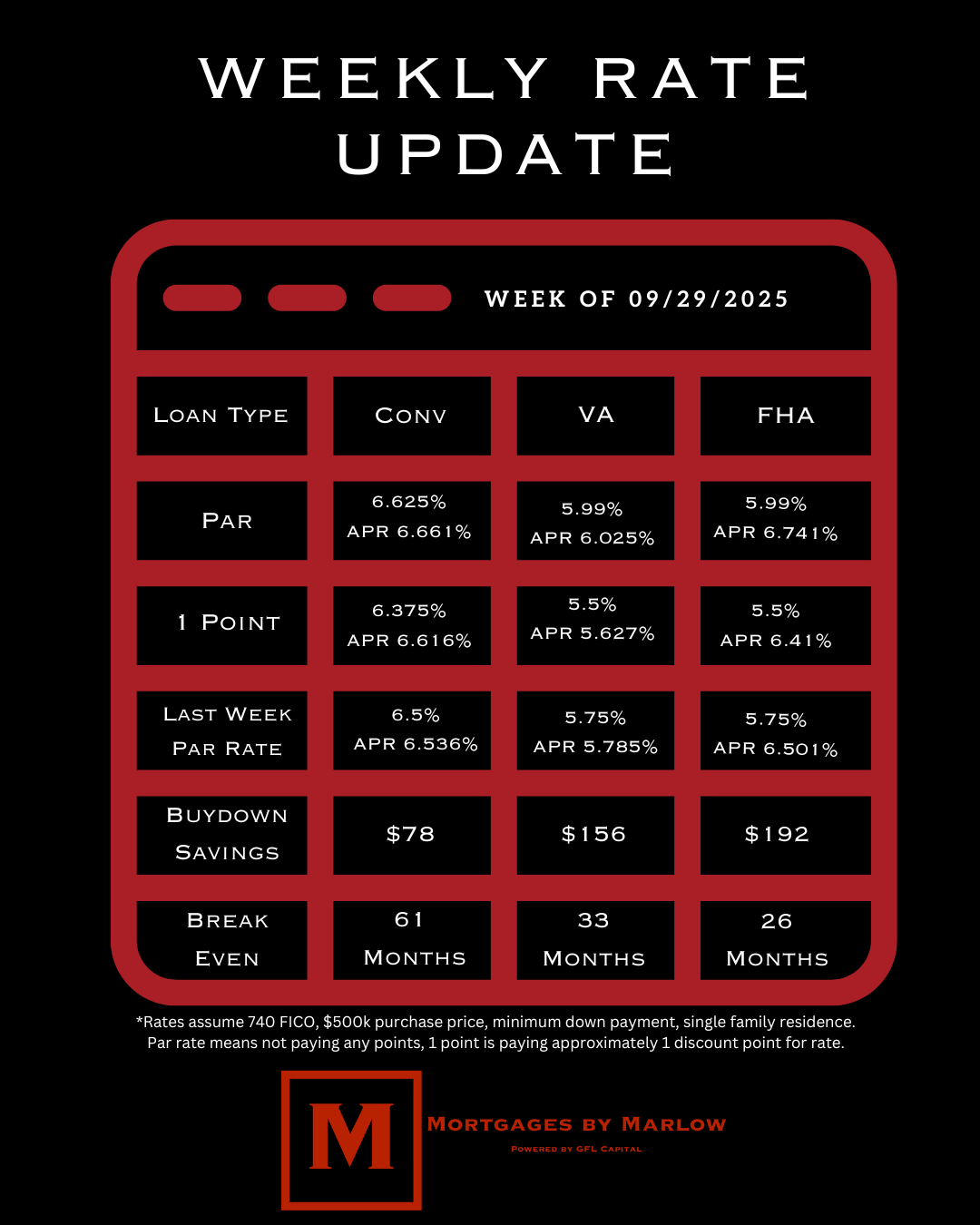

Conventional par rates edged higher from 6.50% to 6.625%, showing upward pressure despite Fed cuts. VA and FHA held more favorable ground, with par rates at 5.99%, but both still higher than last week’s 5.75%.

Overall trend: rates are creeping up, not down, so waiting buyers may miss the sweet spot we are currently in.

The national average for 30 year fixed conventional is sitting at 6.38% according to mortgage news now. (Assumes 25% down, excellent credit, single family home, and ~1 point buydown.)

Other Helpful Articles

- PCE Inflation Data ‘Mildly Reassuring’ As Many Hope For Continued Rate Cuts

- 7 Ways to Sell More Homes Without Posting More Videos

- Volatility Potential Hinges on Government Shutdown Odds

Two Ways I Can Help

- Let’s collaborate — schedule a Zoom meeting with me here and let’s talk shop. I’m always down to mastermind and ideate.

- Tough deal? My team and I routinely save deals for our agent partners—loop me in before throwing in the towel.