Thanksgiving Week Mortgage Update: Softer Rates, Fed Signals, and Las Vegas Housing Insights Good...

Rates dip slightly after $200B MBS announcement

We saw a nice little tailwind for the mortgage markets last week after the president shared on social media that he’s directed his team to purchase $200 billion in mortgage-backed securities (MBS). That headline alone was enough to get investors’ attention and has nudged rates a bit lower.

However, until there’s a clear, formal plan for how and when those purchases will happen, this rally is very fragile. The improvement is real, but volatile, and not guaranteed to stick.

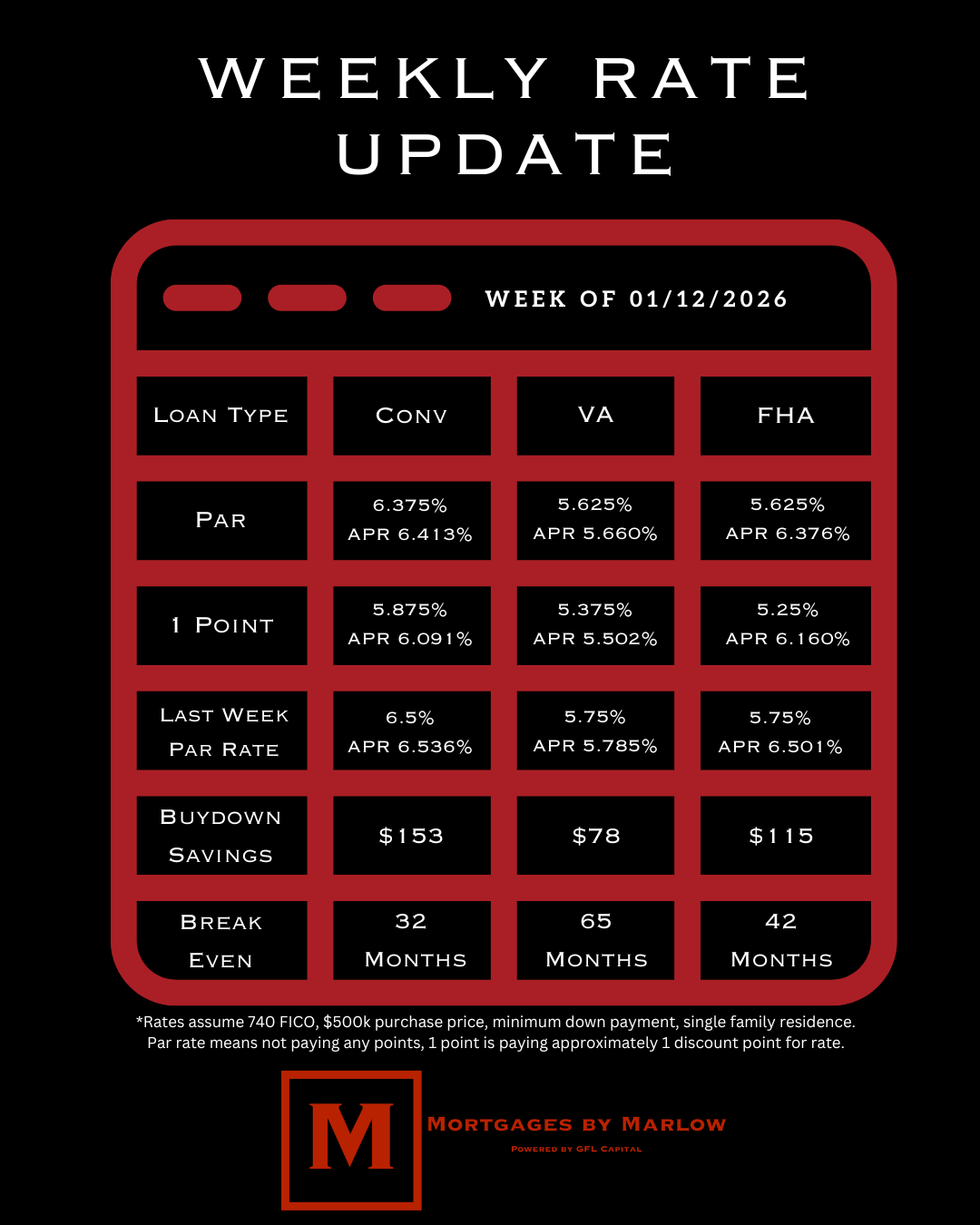

Right now, most lenders are coming in about 0.125% lower in par rates than we saw this time last week.

Mortgage Rates ⬇️

This week is packed with economic reports that could move the bond market.

The two big ones to watch:

- CPI (Consumer Price Index) inflation report – releasing tomorrow

- PPI (Producer Price Index) – releasing Wednesday

If those readings come in “friendly” (showing cooler inflation), they could help reinforce the downward trend we’ve been seeing in rates. On the other hand, if inflation surprises to the upside, we could see some of these recent gains in rates get erased.

As of today, the national average for a 30-year fixed conventional mortgage is sitting at 6.06% according to Mortgage News Daily.

This assumes 25% down, excellent credit, a single-family home, and on average a one-point buydown. Your scenario may price differently based on your specific profile and goals.

Other Helpful Articles

If you want to go deeper on market timing, strategy, and what to do when rates move, these are worth a read:

- The Best & Worst Times to Buy a House in 2026

- The Mistake Most Agents Make After Mortgage Rates Drop

- BREAKING: Fed Chair Powell Reveals Looming Indictment, Decries ‘Intimidation’

Two Ways I Can Help

- Let’s collaborate – Want to brainstorm strategies for your 2026 business plan, database outreach, or how to talk about this MBS news with your clients? You can schedule a Zoom with me here and we’ll talk shop. I’m always down to mastermind and ideate.

- Have a tough deal? My team and I routinely save deals for our agent partners. If you’ve got a transaction going sideways, reach out before you throw in the towel—there may be options you haven’t been shown yet.

“The best way to predict the future is to create it.”

— Peter Drucker